Real estate capital growth investing involves buying a property with the goal of holding onto it for a period of time in order to sell it later at a higher price. The goal is to achieve a profit from the difference between the purchase price and the sale price, also known as the capital gain. Capital growth investing can be a long-term strategy, as it can take time for a property to appreciate in value. There are a number of factors that can impact the potential for capital growth, such as the location of the property, the type of property, and the overall economic conditions of the area. It’s important to carefully research and consider these factors before making any investment decisions. It can also be helpful to seek professional advice from a real estate agent or financial advisor. While there are no guarantees in the world of investing, those who are patient, 7 – 10 years and do their due diligence may be able to achieve a healthy return on their investment through capital growth in real estate.

Here are my 10 metrics for capital growth:

-

- Location: The location of the property plays a big role in its potential for capital growth. Look for properties in areas that are expected to see population and economic growth.

- Property type: Different types of properties can offer different opportunities for capital growth. For example, houses offer more potential for capital growth than units, but units may be more affordable and offer higher rental yields.

- Demographics: Consider the demographics of the area where the property is located. Properties in areas with a high proportion of families or young professionals may be more likely to experience capital growth compared to those in areas with an aging population.

- Infrastructure: Good infrastructure, such as public transport, schools, and hospitals, can drive demand for properties and contribute to capital growth.

- Economic conditions: The overall economic conditions of the area can impact capital growth. Look for areas with low unemployment rates, a diverse economy, and stable or growing industries.

- Planning and zoning regulations: Research the planning and zoning regulations in the area where the property is located. Changes to these regulations can affect the supply and demand for properties and therefore impact capital growth.

- Rental demand: Investing in a property with strong rental demand can provide a steady income stream and help to offset any periods of stagnant capital growth.

- Maintenance and repairs: Proper maintenance and timely repairs can help to preserve and even increase the value of a property. Neglecting these tasks can have the opposite effect.

- Renovations and improvements: Undertaking renovations and improvements can add value to a property and therefore increase its potential for capital growth. However, be mindful of the costs and ensure that the renovations are in line with the local market.

- Holding period: The length of time that a property is held can impact its potential for capital growth. In general, the longer a property is held, the more time there is for capital growth to occur. However, regularly review the performance of the property and make any necessary adjustments to your investment strategy.

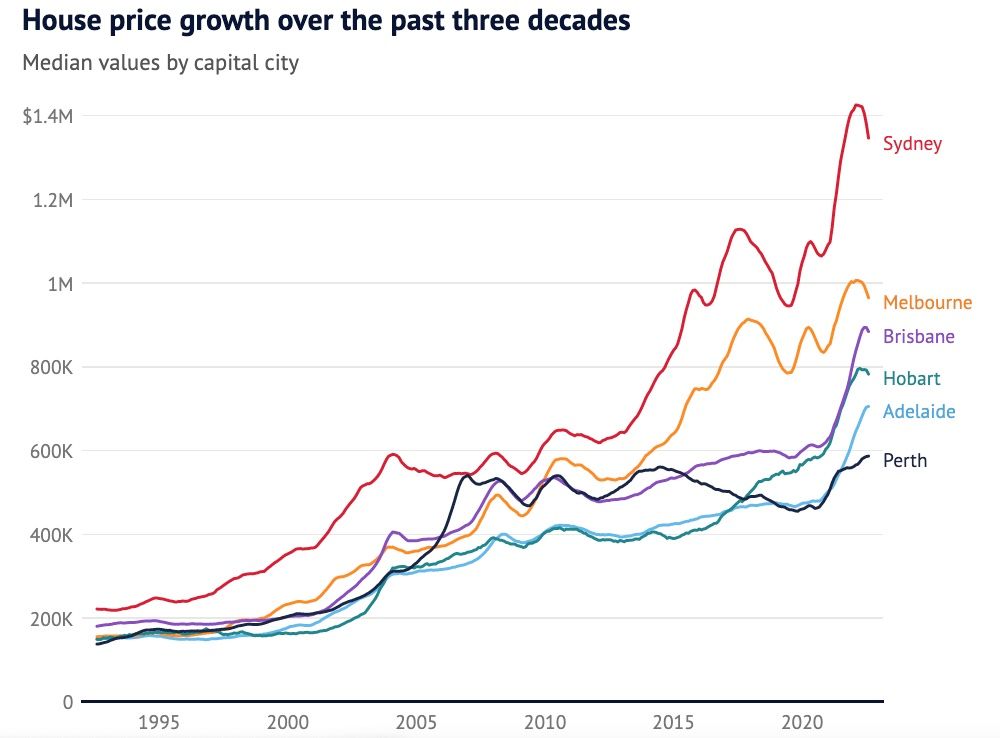

Investing in capital growth can be highly profitable if you have a good understanding of the market. Some investors have seen their portfolios double in value every 7 to 10 years by investing in Australian capital cities. Although there’s no guarantee that these investments will double again, it is still possible to find undervalued properties that are likely to experience consistent capital growth over a significant period.

Reach out below and we can discuss how to find the best capital growth areas in Australia.

Disclaimer: The information provided in this article is solely the author’s opinion and not investment advice – it is provided for educational purposes only. By using this, you agree that the information does not constitute any investment or financial instructions. Do conduct your own research and reach out to financial advisors before making any investment decisions.