The Importance of a Growing & Diverse Economy

A diverse and growing economy is important when investing in property because it provides a wide range of opportunities for individuals and businesses, leading to a higher standard of living for people. A diverse economy will help to reduce the risk of a recession caused by a downturn in a particular industry, for example the mining boom in Western Australia back in 2010. This boom created artificial price increases and then a large housing downturn for 10 years after. Additionally, a growing economy creates more jobs, leading to lower unemployment rates and providing a wide range of opportunities to people regardless of their skills and experience. Furthermore, a growing economy will also attract foreign investment and lead to the development of infrastructure which are essential to the growth of businesses and support the needs of the people. A diverse and growing economy can help to reduce income inequality and improve overall well-being of people living in the area.

I have included some of the main things I look for in an economy before making a real estate investment purchase below:

- Economic growth: Economic growth is measured by the increase in a country’s gross domestic product (GDP) over time. It is important to note that sustained economic growth over a 20 year period is a good indicator of a stable and diverse economy, as short-term growth can be volatile and unsustainable. Economic growth is usually driven by increased productivity and innovation, which can lead to higher wages and job opportunities for individuals.

- Job creation: Job creation is an important aspect of a growing economy, as it not only reduces unemployment rates but also provides individuals with the opportunity to earn a living and improve their standard of living. It is important that these jobs are created across a range of industries, as this reduces the impact of economic downturns in any one particular industry. For instance, a region that is heavily reliant on one industry, such as mining, may suffer greatly during an economic downturn in that industry.

- Low inflation: Inflation is the rate at which prices of goods and services increase over time. High inflation can lead to a decrease in the purchasing power of individuals, as their income may not keep pace with rising costs. Therefore, low inflation rates are desirable for a healthy economy as it promotes consumer confidence, encourages investment and borrowing, and reduces the cost of living.

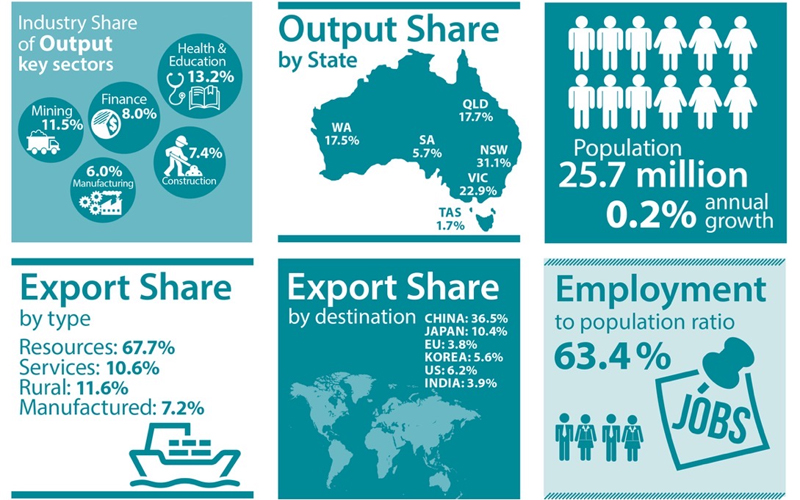

- Export diversity: An economy that is diverse in its exports is less dependent on any one particular industry and is better equipped to weather economic downturns. For instance, a region that exports a variety of goods and services, such as technology, agriculture, and tourism, is less likely to be affected by a decrease in demand for any one particular industry. This also helps to mitigate the risk of a single market or region experiencing a downturn.

- Foreign investment: Foreign investment is an important aspect of a growing economy, as it can lead to job creation, increased productivity, and innovation. A region that is attractive to foreign investors will likely experience increased economic activity, which can help to spur economic growth. This is particularly important for regions that may not have the domestic resources to support economic growth on their own.

- Infrastructure development: Infrastructure development is a necessary component of a growing economy, as it helps to support businesses and individuals. Infrastructure such as roads, airports, ports, and hospitals can help to increase productivity, reduce transportation costs, and improve the quality of life for individuals. Investment in infrastructure also has long-term benefits for a region, as it can attract new businesses and increase economic activity.

- Consumer confidence: High consumer confidence indicates that individuals are optimistic about the economy, which can lead to increased spending and economic activity. The wealth effect refers to the phenomenon where individuals feel more confident about their financial situation and therefore are more likely to spend money freely. This can lead to increased economic growth, as businesses benefit from increased demand for their goods and services.

- Public policies and regulations: Public policies and regulations that are supportive of business growth and development can play a significant role in a growing economy. For instance, policies that encourage investment, innovation, and job creation can help to spur economic growth. Regulations that promote fair competition, protect intellectual property, and ensure a level playing field can also help to promote economic growth by creating a stable business environment.

Before you invest anywhere, you need to understand the economic background of the region or city. This will help you to make a calculated decision on where that economy is heading and if people will likely be getting paid more in the future. When people are paid more, it attracts more talent, and it also enables them to spend more on real estate, increasing values and rents in the area.

If you want to learn more about economies that are performing well in Australia, feel free to reach out below.

Disclaimer: The information provided in this article is solely the author’s opinion and not investment advice – it is provided for educational purposes only. By using this, you agree that the information does not constitute any investment or financial instructions. Do conduct your own research and reach out to financial advisors before making any investment decisions.