Property Investment vs. Stock Market: An Analysis for Aspiring Investors.

Navigating the investment landscape can be a challenging task, particularly when faced with the decision of where to put your money. Property investment and the stock market are two popular options that each have their unique characteristics, risks, and potential returns. Understanding these elements is crucial in shaping your investment strategy and achieving your financial objectives.

Property investment involves the purchase of properties for rental income or capital appreciation. On the flip side, stock market investment entails buying shares in publicly traded companies, hoping for dividends or capital gains. This guide aims to provide a comparative analysis of these two popular investment options, taking you through their basics, potential returns, risk factors, and the effects of market conditions. Let’s delve into this journey of exploration and make a well-informed investment decision.

- The Basics of Property Investment and Stock Market Investments

Property Investment Essentials In essence, property investment is about acquiring property in anticipation of an increase in value over time, resulting in a return on investment. This can come either through rental income or the eventual sale of the property. Since properties are tangible assets, investors often find a sense of security and control in this type of investment.

Understanding Stock Market Investments In contrast, investing in the stock market means buying a portion of a company in the form of shares or stocks. When you purchase a stock, you buy a piece of the company, hoping that the company will do well, leading to an increase in the stock’s price. Some stocks also pay dividends, providing an income stream to investors. Though stocks are intangible, they offer an opportunity for swift and broad diversification across various sectors.

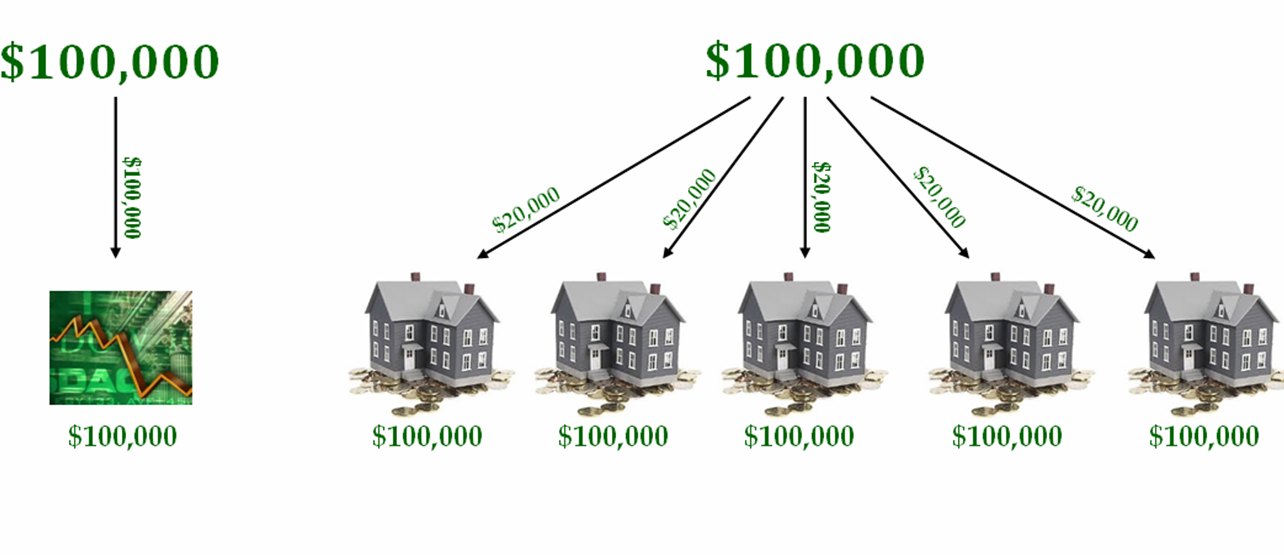

- Potential Returns: Property Investment vs. Stock Market

Profit Prospects in Property Investment Returns in property investment mainly come from rental income and appreciation in property value. Consistent rental income can offer a financial cushion in times of market uncertainty, and over the long term, properties generally appreciate in value, providing a significant return upon sale. Moreover, property investment presents tax benefits, including deductions on mortgage interest, property taxes, and depreciation.

Earnings from Stock Market Investments The stock market offers potential returns in two ways – dividends and capital appreciation. Dividends are portions of a company’s profit that are distributed to shareholders, providing a regular income stream. Capital appreciation occurs when a stock’s price increases, creating the potential for high returns, particularly for growth stocks. However, stock prices can be highly volatile, fluctuating greatly in the short term.

- Risk Factors in Property Investment and Stock Market Investments

Navigating Risks in Property Investment Like all investments, property investment comes with its share of risks. Property values can decrease due to a variety of factors, including economic conditions, property market trends, or issues specific to the property itself. Investing in rental properties brings its own set of challenges, such as periods without tenants, costly repairs, and potential issues with tenants. Moreover, properties are less liquid than stocks, making it harder to quickly sell if you need to liquidate your investment.

Understanding Risks in Stock Market Investments Investing in the stock market carries its own unique risks. Stock prices can be volatile and are influenced by a variety of factors, including economic indicators, corporate earnings reports, geopolitical events, and market sentiment. Although it’s generally easier to sell stocks compared to properties, selling during a market downturn could result in substantial losses. Diversification can help mitigate some of these risks, but understanding and accepting these risks is a key aspect of investing in the stock market.

- The Impact of Market Conditions on Property Investment and Stocks

Market Dynamics and Property Investment Property markets are often influenced by local factors like employment rates, income levels, and demographic trends. These factors can affect both the value of the property and its potential rental income. Furthermore, interest rates can have a significant impact on property markets, as changes in rates can affect both property values and the cost of borrowing for property investment.

Influencing Factors in Stock Market Investment The stock market is affected by a wide range of national and international factors. These include economic indicators, corporate earnings, geopolitical events, and changes in monetary policy. The stock market tends to be more volatile than the property market, with stock prices capable of large increases or decreases in a short period.

- The Role of Diversification in Property Investment and Stock Investments

Portfolio Diversification through Property Investment Property investment can provide diversification benefits to your investment portfolio. Properties typically have a low correlation with other major asset classes, meaning they tend to move independently of the stock and bond markets. As such, property investment can offer a safeguard against volatility in other parts of your portfolio.

Achieving Diversification through Stocks The stock market also presents opportunities for diversification. By investing in a variety of companies, sectors, and countries, you can spread your risk and potentially improve your risk-adjusted returns. Diversification in the stock market can be achieved relatively easily, particularly through mutual funds and exchange-traded funds (ETFs).

- Choosing Between Property Investment and Stock Market: A Personal Decision

Personal Factors Influencing Investment Choice Choosing between property investment and the stock market is a personal decision, influenced by your financial goals, risk tolerance, investment knowledge, and interest. If you enjoy researching companies and tracking market trends, you might find investing in stocks appealing. On the other hand, if you prefer the tangible aspect of properties and enjoy managing them, property investment could be your path.

Aligning Investment with Financial Goals It’s important to remember that it’s not necessarily a choice between one or the other. Many successful investors include both property and stocks in their portfolios. What’s most important is that your investment decisions align with your financial goals and overall investment strategy. Consider your risk tolerance, investment horizon, income needs, and overall investment objectives when making your decision.

In the journey of real estate versus stock market investments, we’ve explored the basics, potential returns, risks, and the impact of market conditions. It’s evident that both real estate and stocks have their unique benefits and challenges. The key to successful investing lies in understanding these elements, diversifying your investment portfolio, and aligning your investments with your personal financial goals.

Both real estate and stock market investments can play a significant role in wealth accumulation and financial security. If you’re contemplating these investment routes or seeking further advice on shaping your property investment strategies, don’t hesitate to reach out to us. We’re here to guide you through your investment journey, helping you make informed decisions that lead to financial success.

Disclaimer: The information provided in this article is solely the author’s opinion and not investment advice – it is provided for educational purposes only. By using this, you agree that the information does not constitute any investment or financial instructions. Do conduct your own research and reach out to financial advisors before making any investment decisions.