Property Investment Rental Yields Explained

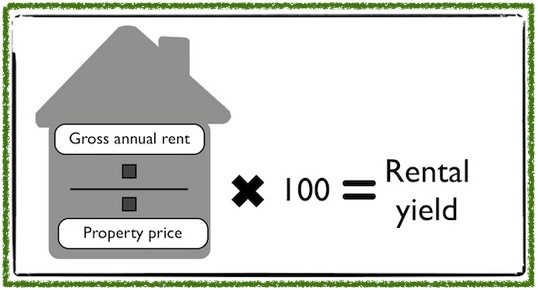

Investing in property can be an excellent way to grow your wealth over time. However, to make the most out of your investment, you need to understand how rental yields work. In simple terms, rental yield is the amount of money you make as an investor by renting out your property. To calculate it, you need to divide the annual rental income by the value or purchase price of the property and express the result as a percentage.

For instance, let’s say you purchased a property for $450,000, and it generates $24,000 annually in rental income. By dividing the rental income by the purchase price and multiplying it by 100, you can determine the rental yield, which, in this case, would be 5.3%. But why is understanding rental yield so important for property investors? Well, for starters, it helps you determine whether or not your investment is profitable. If your rental yield is low, it might not be worth your time and money to invest in that particular property.

On the other hand, a high rental yield indicates that you’re generating significant returns on your investment. Moreover, if the rental yield is higher than the interest rate charged by your bank, you’re effectively earning extra money by leveraging the bank’s funds. This is an excellent opportunity to pay off your debt quickly and enjoy a steady passive income stream.

Three things that assist with a high rental yield:

- Location, Location, Location: We’ve all heard it before, but it’s true – location is everything when it comes to real estate investing. A prime location can greatly increase your rental yields and attract quality tenants. Research the area thoroughly before making any investment decisions. Look for locations with high demand for rentals and low vacancy rates. It’s also important to consider the competition – investing in an area with too many other investors can dilute your returns.

- Property type: Choosing the right property type can also impact your rental yields. Properties with multiple rental options on one block, such as duplexes, houses with granny flats, or unit blocks, can provide multiple income streams and increase your returns. It’s also important to consider the target market – for example, investing in student accommodation near universities or in family-friendly suburbs.

- Maintenance costs: Don’t overlook the potential maintenance costs when considering an investment property. Older homes may seem like a bargain, but high maintenance costs can quickly eat away at your profits. Before making any purchase, ensure that the property is in sound condition and won’t require expensive repairs in the near future. Factor in ongoing maintenance costs, such as lawn care and pest control, when calculating your rental yields. If you’re considering a fixer-upper, make sure you have a solid renovation plan and budget in place before proceeding.

In summary, while rental yields are vital to consider when investing in real estate, they should not be the only factor that you base your decision on. You must also take into account your investment strategy and goals to determine the best property to buy. It is essential to thoroughly research the market, location, property type, and potential maintenance costs to maximize your returns. By conducting your due diligence and carefully evaluating each investment opportunity, you can make informed decisions that align with your investment goals and set yourself up for success in the real estate market. If you want to learn more about rental yields, feel free to reach out below and we can catch up.

Disclaimer: The information provided in this article is solely the author’s opinion and not investment advice – it is provided for educational purposes only. By using this, you agree that the information does not constitute any investment or financial instructions. Do conduct your own research and reach out to financial advisors before making any investment decisions.