Real estate market cycles refer to the periodic fluctuations in the housing market that impact the value of properties. These cycles can be influenced by several factors, including economic conditions, interest rates, housing supply and demand, and government policies. The duration of these cycles can vary, but typically they occur over a 5-10 year period.

It’s crucial for property investors to understand how to read market cycles to make informed decisions about when to buy, hold or sell their properties. If you buy a property at the peak of a market cycle, you may end up overpaying for it and struggle to achieve capital growth. On the other hand, buying a property at the bottom of a cycle could provide an opportunity to purchase an undervalued asset that has the potential to appreciate in value over time.

My top 7 things to help you understand how to read a market cycle:

- Economic Growth: During the economic growth phase, the demand for housing increases as the economy grows. This can lead to a shortage of available properties for either rent or sale, which drives up property prices. As economic growth is often reported by the government through data such as gross domestic product (GDP), property investors can use this information to identify potential opportunities for capital growth.

- Peak/Euphoria: The peak or euphoria phase is characterized by a high level of enthusiasm and optimism in the real estate market. Property prices reach their highest point, and people may begin to pay inflated prices for properties. Inflation can also increase due to the “wealth effect” created by rising property prices. Property investors should consider their market exit options during this phase and may decide to sell their properties to realize profits before the market slows down.

- Interest Rate Rises/Recession: When the government raises interest rates, it becomes more expensive for people to borrow money, and fewer people can afford to buy or rent properties. This can lead to a slowdown in the property market or even a decrease in property values. Property investors need to be aware of interest rate changes as they can have a significant impact on the property market.

- Bottom: The bottom of the market cycle is a great time to buy as property prices are often at their lowest point. Distressed sales and discounted listings may be available, providing opportunities for property investors to purchase properties at a discount. By buying during this phase, investors can capitalize on potential capital growth as the market recovers.

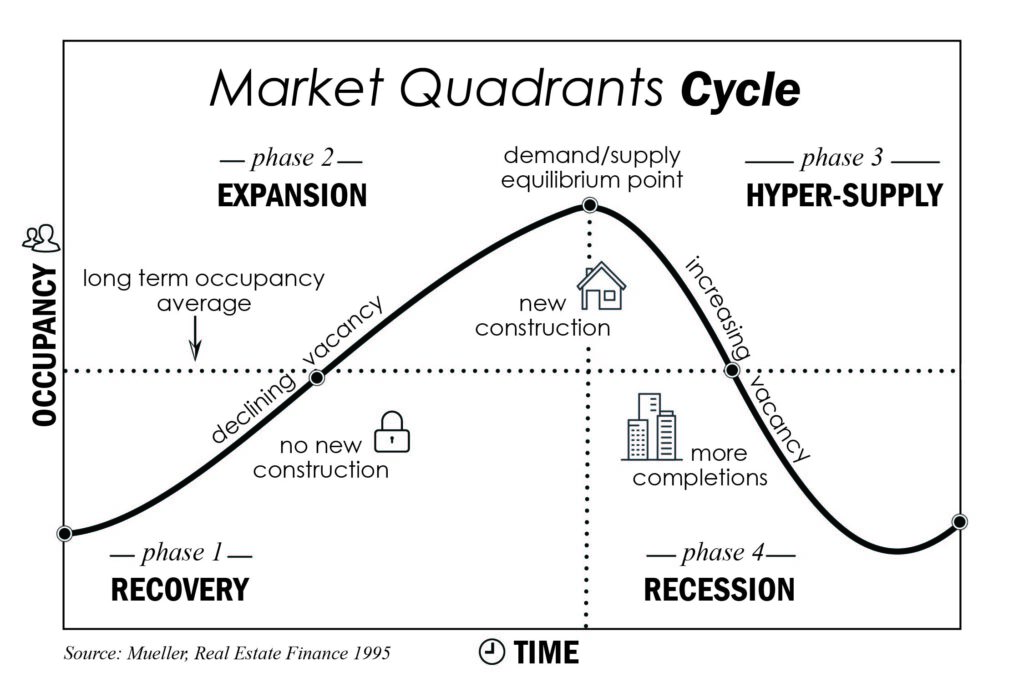

- Recovery: During the recovery phase, values become more consistent, and some areas may become competitive again. This can lead to rising property prices, which may present opportunities for property investors to realize capital growth.

- Expansion: The expansion phase follows the recovery phase and is a great time to find value-add properties. These properties can be purchased at a discount, renovated, and then sold for a profit, capturing the added value benefit and capital growth over the holding period.

- Interest Rates: Interest rates are a core factor that can move markets around the world. Property investors need to understand how interest rates work, as they can have a significant impact on the property market. For example, if money is cheap, people are more likely to borrow and spend, driving up property prices. If interest rates are high, people are more likely to contract and wait for better times, which can lead to a slowdown in the property market. By keeping an eye on interest rates, property investors can make informed decisions about when to buy, hold or sell their properties.

Real estate market cycles can be complex and influenced by a variety of factors. While the six phases outlined in the previous answer can provide a general framework for understanding the market, it’s important to note that these phases may not always occur in a predictable order or with the same duration or intensity.

In addition, external factors such as changes in interest rates, consumer confidence, and global events can have a significant impact on real estate markets. For example, unexpected events such as the COVID-19 pandemic can disrupt the market cycle and create unexpected changes in supply and demand.

That’s why it’s crucial for real estate investors to stay informed about the broader economic factors and world events that may influence the market cycle. This knowledge can help them make informed decisions about when to buy, sell, or hold their real estate investments. If you want to learn more about real estate market cycles, reach out, and we can have a chat about what is currently happening within the Australian real estate market.

Disclaimer: The information provided in this article is solely the author’s opinion and not investment advice – it is provided for educational purposes only. By using this, you agree that the information does not constitute any investment or financial instructions. Do conduct your own research and reach out to financial advisors before making any investment decisions.