The fundamental principle of supply and demand plays a critical role in the Australian real estate market. As property investors, understanding how these forces interact can provide valuable insight into market trends and opportunities. In this article, we will discuss the factors that create supply and demand imbalances in the property market and how our company leverages this knowledge to help investors stay ahead of the game.

The Impact of Supply and Demand in Real Estate

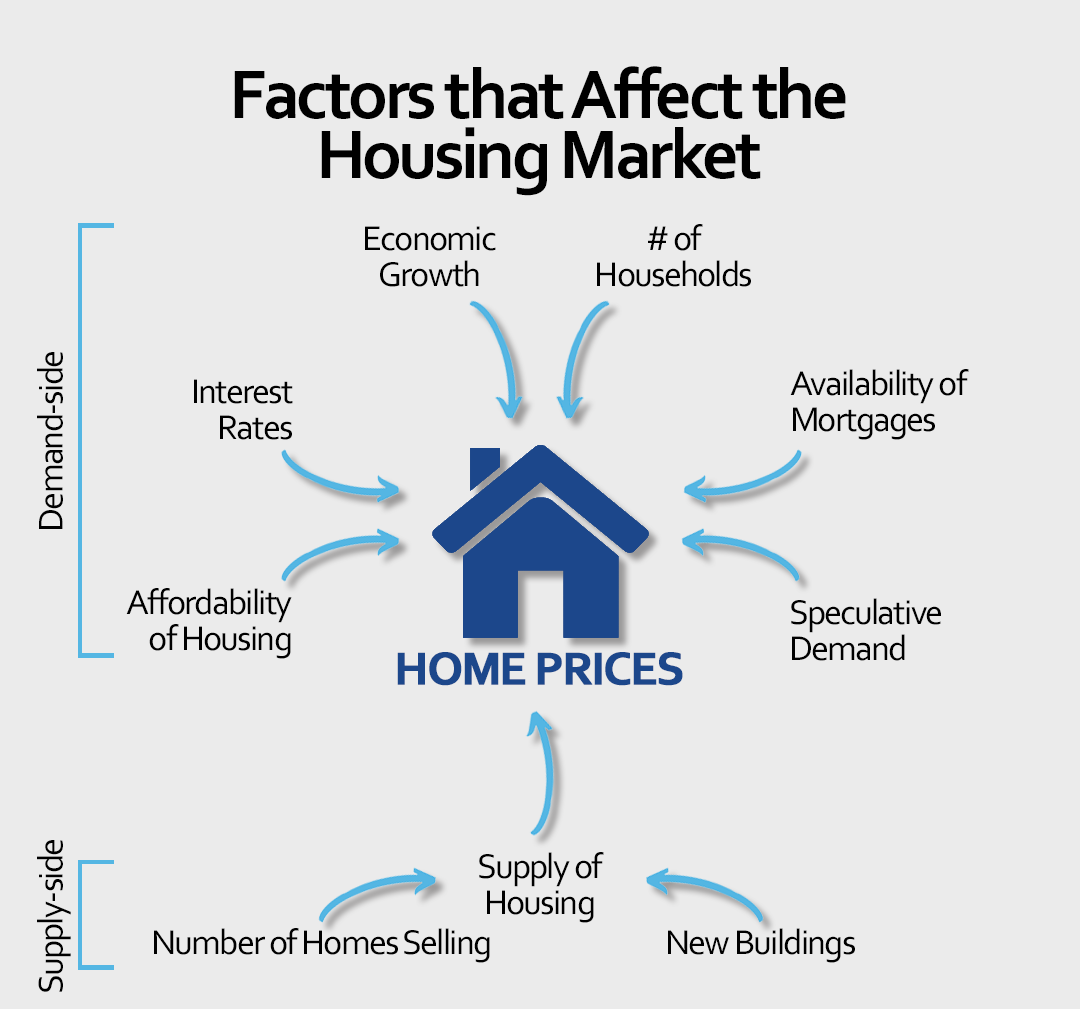

In the property market, supply refers to the availability of properties for sale or rent, while demand refers to the number of potential buyers or renters. When demand exceeds supply, property prices tend to rise, creating opportunities for investors to capitalise on capital growth. Conversely, an oversupply of properties can result in falling prices and reduced investment returns.

Several factors can create supply and demand imbalances in the property market, some of which include:

Land locking

Land locking refers to the limited availability of land for development due to geographical constraints or strict zoning regulations. In certain areas, the scarcity of land can lead to a significant increase in property prices, as developers struggle to meet the demand for housing.

Some factors contributing to land locking include:

- Geographical constraints: Natural barriers such as mountains, bodies of water, or protected conservation areas can restrict the expansion of a city or suburb, limiting the amount of land available for development.

- Zoning regulations: Strict zoning laws can prevent the development of certain types of properties in specific areas, further constraining the supply of new housing.

- Urban planning: Poor urban planning can result in land being underutilised or poorly allocated, exacerbating land locking issues.

By identifying regions experiencing land locking, investors can capitalise on the rising property prices driven by the limited supply of housing.

Slow construction finishes

Delays in construction projects can lead to a temporary shortage of properties, causing prices to rise as demand outstrips supply. Slow construction finishes can occur due to various reasons, including:

- Regulatory issues: Lengthy approval processes or disputes over permits can delay construction projects, leading to a lag in the supply of new properties.

- Labour shortages: A lack of skilled labour or workforce disruptions can slow down construction, causing delays in property completions.

- Financial constraints: Developers may face financial difficulties or funding issues, resulting in project delays or even cancellations.

By monitoring areas with ongoing construction delays, investors can identify potential investment opportunities arising from the temporary supply shortage.

Large migration

Significant population growth, either from interstate or overseas migration, can lead to increased demand for housing, putting upward pressure on property prices. Factors driving large migration include:

- Economic opportunities: Job creation or booming industries can attract workers and their families to a particular region, increasing the demand for housing.

- Lifestyle factors: People may be drawn to specific areas due to factors such as climate, recreational activities, or education facilities, driving up the demand for properties in these locations.

- Government policies: Immigration policies and regional development initiatives can influence population growth and distribution, impacting housing demand.

By staying informed about migration trends and identifying areas experiencing significant population growth, investors can capitalise on the increased demand for housing in these regions.

Infrastructure projects

Large-scale infrastructure projects often require a substantial workforce, leading to an influx of workers and their families into an area, thereby increasing demand for housing. Some examples of infrastructure projects that can impact property demand include:

- Transportation projects: The construction of new roads, railways, or airports can improve accessibility and attract businesses and residents, leading to increased property demand.

- Energy projects: The development of power plants or renewable energy facilities can create job opportunities and stimulate local economies, boosting demand for housing.

- Social infrastructure: The establishment of new hospitals, schools, or community facilities can enhance the appeal of an area, driving up demand for properties.

By keeping a close watch on upcoming infrastructure projects and their potential impact on local property markets, investors can position themselves to benefit from the increased demand for housing in these areas.

Our Company’s Approach to Identifying Opportunities

As a leading buyer’s agency, our goal is to give property investors an edge by identifying areas with favourable supply and demand conditions before they become widely known in the media. We achieve this through:

- In-depth research: Our team of experts constantly monitor market trends and data to identify areas with strong growth potential, driven by factors such as land locking, slow construction finishes, and large migration.

- Local knowledge: We leverage our extensive network of contacts in the Australian real estate industry to gain insights into local conditions and upcoming infrastructure projects, enabling us to spot potential opportunities early.

- Tailored advice: We work closely with our clients to understand their investment goals and risk appetite, allowing us to provide personalised recommendations that align with their unique objectives.

Understanding the dynamics of supply and demand in the property market is crucial for successful property investment. By staying informed about the factors that create supply and demand imbalances and leveraging the expertise of a reputable buyer’s agency, investors can capitalise on market opportunities before they become widely known. Our company is committed to providing the insights and guidance needed to help property investors navigate the complexities of the Australian real estate market, ensuring they make well-informed decisions and maximise their returns.

Disclaimer: The information provided in this article is solely the author’s opinion and not investment advice – it is provided for educational purposes only. By using this, you agree that the information does not constitute any investment or financial instructions. Do conduct your own research and reach out to financial advisors before making any investment decisions.